Following through on our beliefs

To help us turn our commitment to investing for return while contributing to the common good into the best possible measurable outcomes, we have used external frameworks to structure and assess what we do, such as Impact Frontiers. We are Investment Committee (leadership council) members of the GIIN (Global Impact Investing Network) and a founding member and sponsor of the European chapter of CREO (Clean, Renewable and Environmental Opportunities), a platform for asset owners interested in collaborative education and investing in the environmental, clean technology and related marketplace.

Scoring our managers

Our ESG scorecard helps us be consistent with our managers, plotting progress in every strategic area of integrating ESG: in the early stages of due diligence and choosing managers, through to assessing how thorough and effective they are in making ESG part of their work. It standardises what we do and gives our managers clarity about what we want to see and how to deliver it.

Our managers are our partners in achieving the positive outcomes we want to see in the real economy. This is why we engage with them for continuous improvement, using the scorecard as a baseline.

RI put into practice

From values to investments: strategies, procedures and governance to ensure we advance our mission and keep our promises - this is all described in the RI policy (PDF). These two sub policies relate to the RI policy:

- ESG positions & exclusions policy (PDF) + thematic papers

We have identified climate change, human rights and good business conduct as three main topics and priorities for engagement. In this ESG Positions & Exclusions policy, we explain our position and expectations on these themes. - Engagement & voting policy - stewardship (PDF)

Engaging with fund managers across asset classes is a crucial part of our post-investment monitoring process, as they are able to make a difference in the real economy. This policy describes how we effect our influence through the investments.

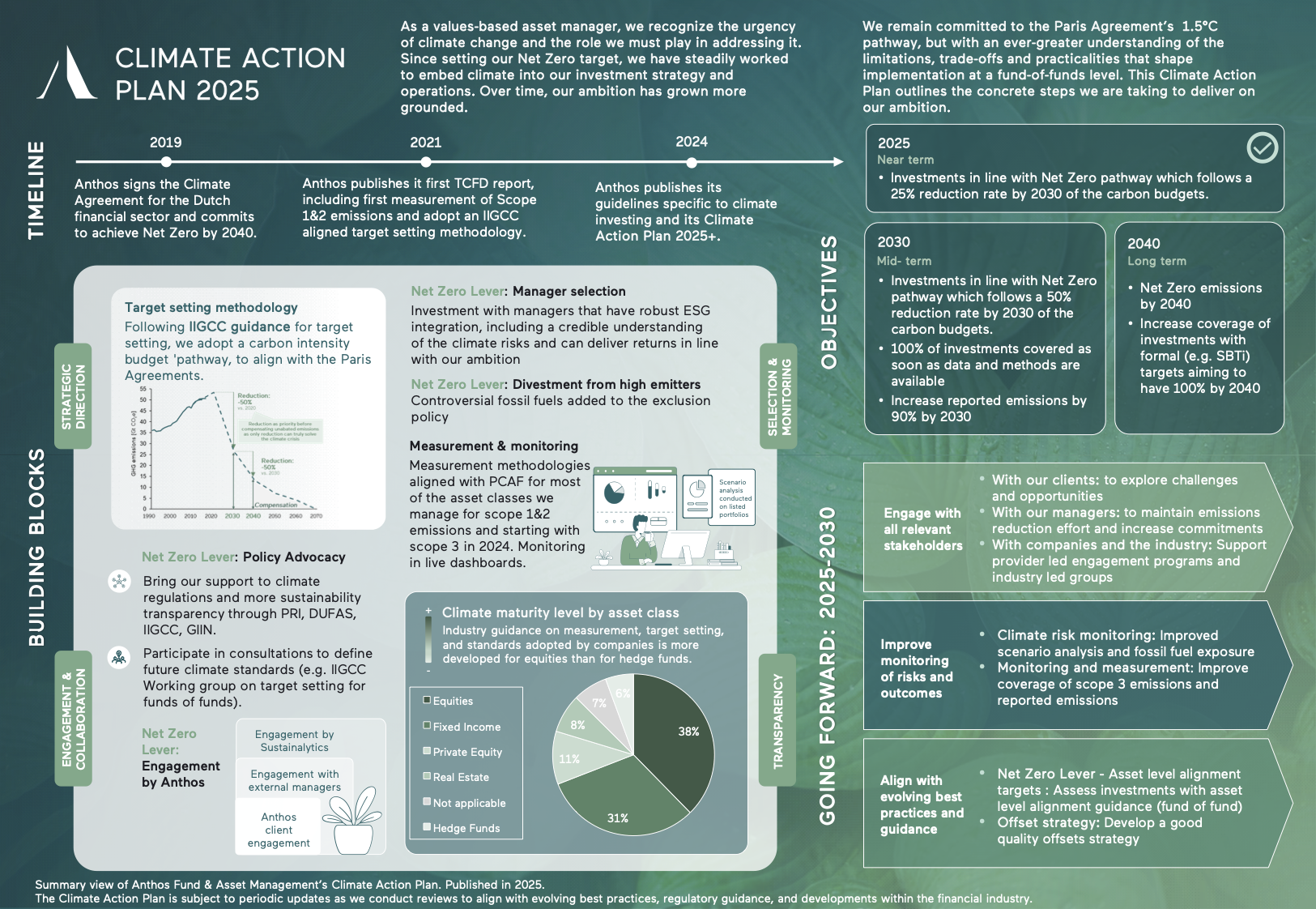

Climate

As a responsible investor, we are concerned about climate change. Resilient climate is the core theme of our portfolio. We are signatory to the Dutch Climate Agreement and we set our ambition to become net zero by 2040. Therefore, we are carbon neutral for our company and measure as well as reduce the carbon footprint of our portfolio. We will report about the progress to become net zero for the portfolio in our annual RI report and the TCFD report.

Climate Action Plan

At Anthos, we believe in creating lasting value while championing environmental stewardship. This commitment drives our efforts to support the global shift towards a Net Zero economy. Our Climate Action Plan 2025 builds on this foundation, detailing our strategies to reduce emissions across investments, enhance climate risk management, and advocate for systemic change in finance. To explore the entire Climate Action Plan click here.

Human Rights

An essential aspect of our spiritual heritage is the value of Human Dignity, the very same that has inspired the UN Declaration of Human Rights, which we adopt as our standard. We recognise that we can only uphold these rights if we create a process to better understand our impact on human rights and labour practices. In 2022, we published our first Human Rights Statement, as a commitment to further strengthen our capacity to respect human rights from the different roles we have as an employer, business owner, through to our investments. Our statement includes our initial plan from 2022 to 2025 and the steps we believe we should take. In 2023, we took one of these first steps and described it into our Human Rights Policy. We are sure that we will learn a lot on the way and we invite our stakeholders to join us on this path.