Summary

The Anthos Fund II RAIF-SICAV – Emerging Markets Bond Fund (hereinafter: the ‘Fund’) promotes environmental or social characteristics. The Fund invests in other investment funds, a so-called ‘fund of fund’. The Fund doesn’t promote directly specific environmental or social characteristics, but overall aims to invest in investment funds that promote one or more environmental and/or social characteristics with an emphasis on governance factors, such as bribery and corruption.

The investment purpose of the Fund is to provide exposure to a portfolio of global emerging markets bonds (in local currency). To meet the environmental or social characteristics promoted, the Fund uses internal assessment methods to review the external investment manager and also the investment fund. The first assessment results in an ESG rating score. Only external investment managers with the two highest ratings (‘professional’ or ‘leader’) are selected by Anthos as a possible investment for this Fund. The second assessment results in an IMP label (Impact Management Project label), with this assessment Anthos looks at the impact intention, allocation, measurement and management of the investment fund. Only IMP labels with an ‘A’, ‘B’ or ‘C’ label are selected by Anthos as a possible investment for this Fund. This Fund primarily invests in emerging market government bonds for which the good governance practices do not need to be assessed. To the extent the Fund has exposure to bonds issued by investee companies, it does not invest directly in investee companies, but indirectly, through its investments in investment funds. Therefore, Anthos expects the investment managers of the investment funds to assess good governance practices of their investee companies.

The Fund aims to invest at least 50% in investment funds aligned with the environmental or social characteristics of the Fund. To monitor the attainment of the promoted environmental or social characteristics of the Fund, the Fund uses the following sustainability indicators:

- at least 80% is invested in investment funds of which the investment managers have been assessed on ESG and which have an ESG rating of "Professional" or "Leader", and

- at least 50% is invested in investment funds assessed with an IMP label “A”, “B” or “C”.

Anthos uses the two internal methodologies to measure attainment of the social or environmental characteristics promoted by the Fund:

a. Internal ESG rating method that looks at the ESG ambitions of the external investment manager and the ESG integration, possible negative impact and exclusions in the investment process of the investment fund, including engagement and reporting in line with relevant standards.

Resulting in an ESG score of ‘Laggard’, ‘Novice’, ‘Professional’ or ‘Leader’.

b. Internal IMP scorecard that looks at the impact intention of the investment fund on ESG elements.

Resulting in an IMP label of ‘A’, ‘B’, ‘C’ or ‘M/D’.

The Fund invests in other investment funds and the data is directly received from the external investment managers. Anthos relies on the provision of accurate and correct information by the external investment manager.

Anthos relies on the external investment managers for engagement with the government of emerging markets.

The below provides more information about how the Fund promotes environmental or social characteristics.

1. No sustainable investment objective

This Emerging Markets Bond Fund promotes environmental or social characteristics but does not have as its objective sustainable investment.

2. Environmental or social characteristics of the financial product

The Fund is a so-called ‘fund of fund’, meaning that it invests in other investment funds. The Fund does not promote specific environmental or social characteristics directly, but overall aims to invest in investment funds that promote one or more environmental and/or social characteristics with an emphasis on governance factors, such as bribery and corruption.

No reference benchmark has been designated to attain the promoted environmental or social characteristics.

3. Investment strategy

The investment strategy of this Fund as set forth in the (binding) fund documentation is to provide exposure to a portfolio of global emerging markets bonds (in local currency). This Fund invests in a diversified portfolio of predominantly, but not solely, emerging market government bonds issued in their respective local currency and other fixed income instruments, following a proprietary responsible investing policy.

As a fund of funds, this financial product invests in investment funds controlled by other investment managers. Promotion of environmental and social characteristics is achieved by selecting investment managers that have excellent Environmental, Social and Governance (ESG) practices integrated in their investment process with well-developed or developing engagement or stewardship approaches. The Anthos Responsible Investment policy, Anthos Positions and Exclusions policy and Anthos Stewardship policy apply to this financial product.

It starts with the selection of investment managers. When selecting investment managers, an internal ESG rating method is used, resulting in an ESG rating score. Anthos reviews the following topics regarding the investment manager as part of the due diligence: Purpose & culture alignment, Diversity, equity and inclusion, Policy and strategy, Resources and governance and Industry leadership.

Next to that Anthos also reviews the following topics regarding the specific fund of the investment manager: ESG integration in the investment process, Negative impact taken into account, Exclusions, Engagement and Reporting in line with relevant standards. Special attention is brought to assess the investment manager’s understanding of governance factors, how these materialize in the Fund, and the strategy of the investment manager to mitigate those risks as well as the impact of governance factors.

Based on the results, the investment manager in relation to the selected fund is assigned a score. There are four possible outcomes, but only investment managers with the two highest ratings (‘professional’ or ‘leader’) are selected by Anthos as a possible investment for this Fund.

Next to the ESG rating Anthos uses another internal methodology resulting in a so-called IMP label. This is a rating on Impact Management Project (IMP). The methodology looks at the impact intention of the fund on ESG elements,. Based on the results, the fund is assigned an IMP label. Also here there are four possible outcomes, but only funds with an ‘A’, ‘B’ or ‘C’ label are a possible investment for this Fund.

The Fund mainly invests in emerging market government bonds. Therefore, the assessment of good governance for investee companies does not apply. To the extent the Fund has exposure to bonds issued by investee companies, it does not invest directly in investee companies, but indirectly, through its investments in investment funds. Therefore, Anthos expects the investment managers of the investment funds to assess good governance practices of their investee companies. Before investing in a new investment fund for this Fund, Anthos performs an assessment on the policies of the investment manager of that investment fund, including good corporate governance practices at investee companies, with respect to sound management structures, employee relations, remuneration of staff and tax compliance, are considered in the investment process.

Such assessment of the investment manager is repeated by Anthos on a periodic basis (mostly yearly). Furthermore, this Fund is screened on a periodic basis (mostly yearly) to determine whether an investee company is violating or at risk of violating, one or more of the UN Global Compact Principles and related international norms and standards.

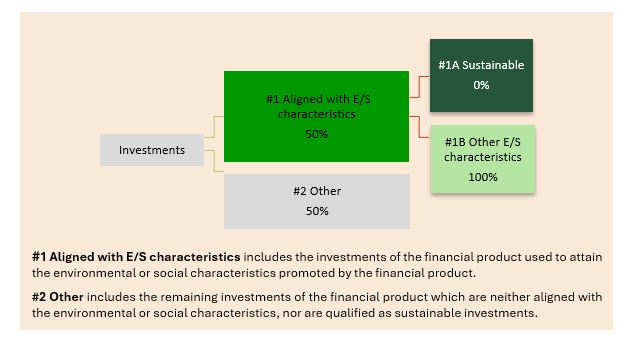

4. Proportion of investments

The Fund aims to invest at least 50% in investment funds aligned with the environmental or social characteristics of the Fund.

5. Monitoring of environmental or social characteristics

Anthos assesses all investment funds that are considered for this Fund on responsible investment practices and key ESG characteristics prior to investing, using its proprietary tools (ESG and IMP scorecard).

Anthos uses the following indicators to measure the attainment of the promoted environmental or social characteristics:

a) at least 80% is invested in investment funds of which the investment managers have been assessed on ESG and which have an ESG rating of "Professional" or "Leader".

b) at least 50% is invested in investment funds assessed with an IMP label “A”, “B” or “C”.

Anthos monitors each indicator on a periodic basis.

In addition to this, Anthos engages on a regular basis with the external investment managers on the components of the ESG scorecard to:

a) ensure the ESG rating correctly reflects the responsible investments practices of the investment manager; and

b) signal the importance of responsible investing, highlight Anthos' expectations about key ESG characteristics (for example, corruption and bribery) and monitor the progress made against Anthos' expectations.

The ESG and IMP scorecard is updated at least once a year to reflect the outcome of the engagement conversations between Anthos and the external investment managers.

6. Methodologies

Anthos uses the following methodologies to measure attainment of the social or environmental characteristics promoted by the Fund:

1. Internal ESG rating method that looks at the following components:

a. With regard to the investment manager: strong governance policies and developed stewardship approach.

b. With regard to the investment fund: ESG integration in the investment process, Negative impact taken into account, Exclusions, Engagement and Reporting in line with relevant standards.

Resulting in an ESG score of ‘Laggard’, ‘Novice’, ‘Professional’ or ‘Leader’.

2. Internal IMP scorecard that looks at the following components: the impact intention of the investment fund on ESG elements, the allocation of assets with an impact intention and how it is measured and managed within the investment fund.

Resulting in an IMP label of ‘A’, ‘B’, ‘C’ or ‘M/D’.

7. Data sources and processing

Anthos collects data from the external investment managers during the due diligence phase and during engagement conversations. The received information is checked by the portfolio managers and their analysts and used for the internal assessment resulting in an ESG rating and an IMP label. The relevant information is reviewed at least once a year. Since all the information is received directly from the investment managers, Anthos doesn’t use any estimated data at the moment.

8. Limitations to methodologies and data

The Fund invests in other investment funds and the data is directly received from the external investment managers. Anthos relies on the provision of accurate and correct information by the external investment manager. Currently, Anthos doesn’t use any external data provider to verify the received information.

Assessing the information shared by the external investment managers may be influenced by the amount of knowledge of the Anthos staff performing the assessment on ESG rating and IMP label. Anthos mitigates this limitation by providing regular training to its staff, either on processes or specific topics (for example climate training and human rights workshops). The RI Team also review the ESG and IMP scores completed by the investment team to ensure the correctness of the scores.

Anthos believes that the use of internal methodologies and the data restrictions do not constrain the Fund to attain the promoted environmental characteristic as Anthos applies periodic controls to ensure the best quality of the data.

9. Due diligence

As part of the due diligence process the external investment manager as well as the investment fund are investigated by the portfolio manager. Therefore, the external investment manager has to provide the information necessary for Anthos to be able to perform the ESG and IMP assessment. Once the information is received, Anthos will assess the information resulting in an ESG score ‘Laggard’, ‘Novice’, ‘Professional’ or ‘Leader’. And also, in an IMP label ‘A’, ‘B’, ‘C’ or ‘M/D’. Anthos will not invest in investment managers and funds with an ESG score Laggard or Novice neither in investment funds with an IMP label M/D.

During the due diligence, the first assessment is done by the portfolio manager, together with their analysts. The assessments are also reviewed by the Anthos Responsible Investments Team on a need basis and the tools are continuously improved to keep up with market standards.

10. Engagement policies

As a fund of fund manager, Anthos invests in investment funds managed by external investment managers, and it relies on these external investment managers for engagement with the government. Anthos has high expectations of the external investment managers selected for this Fund and incorporates ESG considerations into the entire external investment manager due diligence and relationship lifecycle. Anthos expects the selected external investment managers to be signatories of the Principles for Responsible Investment (PRI).