A tailormade, full-service investment solution

What does Outsourced Chief Investment Officer (OCIO) entail in practice?

- Efficient solutions: integrated in-house investment offering

- Multi-asset: broad, global strategies designed to meet client suitability requirements over various economic and market regimes

- Mission driven: solutions use screening methods to act on strong responsible investing policies

- Execution: dynamically managed portfolios, re-allocated and implemented

- Reporting: monthly & quarterly customised client reports, strong ESG data integration & screening capabilities

Our experience and know-how in one full-suite solution

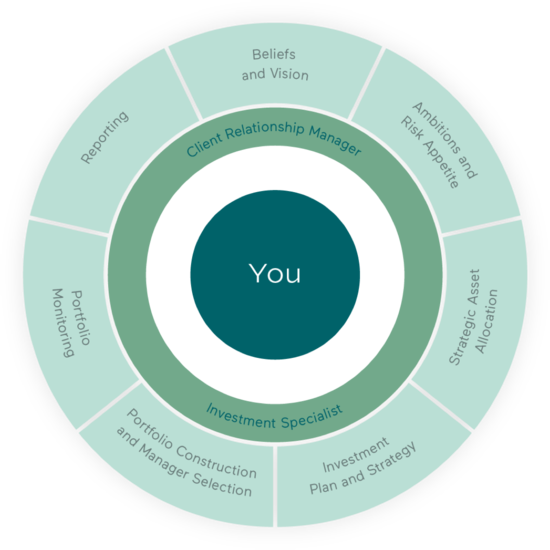

Our OCIO solution offers a full range of integrated in-house investment offerings. In a multi-asset fund-of-funds approach our global strategies meet client suitability requirements over various economic and market regimes.

The approach is a full-service package for clients that seek an all-in investment solution, within a strict responsible investment (RI) framework.

We invest responsibly

We select managers who invest for positive impact in specific sustainable development goals (SDGs) or through a best-in-class approach. In addition, we either report compliance or exposure to companies that are on the exclusion list. In the case of illiquid asset classes, we include RI clauses in the contracts wherever possible.

We invest for impact, using a specifically defined methodology for assessment and management, inclusive of manager selection. Our solutions use screening methods to act on strong responsible investing policies. Our reporting consists of monthly & quarterly client reports, strong ESG data integration & screening capabilities.

Make a bigger impact on the world together

Are you interested in our Outsourced Chief Investment Officer solution?

Please connect with us.