Summary

The Anthos Fund II RAIF-SICAV European Real Estate Fund (hereinafter: the ‘Fund’) promotes environmental or social characteristics. As a fund of funds, this financial product invests in investment funds controlled by other investment managers. The Fund doesn’t promote directly specific environmental or social characteristics, but overall aims to invest in investment funds that promote one or more environmental and/or social characteristics. This financial product promotes environmental and social characteristics, via the following:

- In the selection of the investment managers themselves (measured by the ESG scorecard) and the investment strategies they implement (measured by the ESG scorecard and the IMP scorecard); and

- By engaging with these investment managers on the implementation of ESG practices in their investment and management decisions.

This financial product promotes both environmental and social characteristics by aiming to invest in investment funds with investment managers that have Environmental, Social and Governance (ESG) practices integrated in their investment process with well-developed or developing engagement or stewardship approaches.

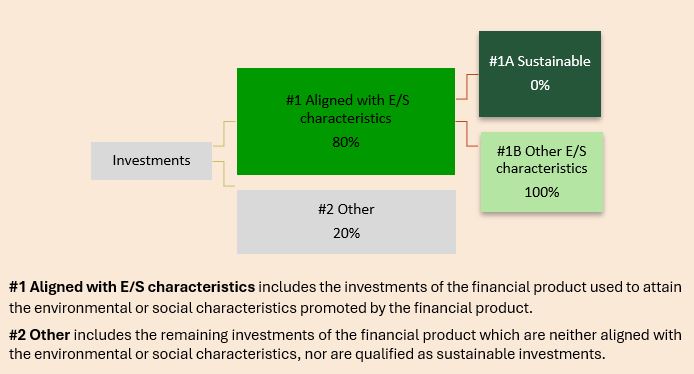

The Fund aims to invest 80% in investment funds aligned with the environmental or social characteristics of the Fund. To monitor the attainment of the promoted environmental or social characteristics of the Fund, the Fund uses the following sustainability indicators:

- At least 80% is invested in investment funds of which the investment managers have been assessed on ESG and which have an ESG rating of "Professional" or "Leader".

- At least 50% is invested in investment funds assessed with an IMP label “A”, “B” or “C”.

- This financial product only invests in investment funds that report to GRESB or have provided a clear commitment to participate. The GRESB initiative enables investment managers to show yearly progress on the most important ESG metrics and provides a strong basis for engagement.

The investment purpose of the Fund is to provide attractive risk-adjusted returns by investing indirectly in real estate, by participating in real estate funds. This financial product invests predominantly in unlisted real estate funds and will adopt a core+ investment theme. It will seek to achieve target returns through strategic allocation based on market analysis and manager selection. Core funds are the basis of the strategy, supplemented by very selected value-add and opportunistic strategies and listed real estate investment funds.

For each of the investment funds that this financial product invests in, the investment managers’ environmental, social and governance practices are evaluated in a scorecard developed by Anthos, based on the UN-backed Principles for Responsible Investment Due Diligence Questionnaires (PRI DDQs), the OECD Guidelines for Institutional Investors and the GRESB framework for Real Estate. The outcome of the scorecard consists of an IMP assessment and an ESG rating, that Anthos uses to measure the attainment of the E/S characteristics promoted for this financial product. As a safeguard of this financial product’s ambition, Anthos also monitors the SFDR financial product classification of the investment funds that this financial product is invested in.

Impact Management Project (IMP) assessment:

This score shows the impact intention of the investment funds that this financial product invests in and the investor influence that the investment manager of that investment fund exercises. An investment fund can have one of the following IMP labels:

- Avoid Harm (IMP label A): the investment fund seeks to improve its impact and avoid the potential negative impact it may cause or have caused.

- Benefit stakeholders (IMP label B): the investment fund seeks to maintain the well-being of one or more group of people and/or the condition of the natural environment within the sustainable range.

- Contribute to solutions (IMP label C): the investment fund seeks to address a social or environmental challenge not caused by the organization by improving the well-being of one or more group people and/or the condition of the natural environment so that it is within the sustainable range.

- May/Does cause harm (IMP label M/D): If the investment fund does not have an impact intention, it is classified as ‘May/Does cause harm'.

ESG rating:

This rating shows the quality of the integration of environmental, social and governance assessments in the investment process at the investment manager. An investment manager can have one of the following ESG ratings: "Laggard", "Novice", "Professional" or "Leader". An investment fund with an investment manager that has an ESG rating of "Professional" or "Leader" will have strong governance policies and requirements, will include sustainable risk assessment as a part of the investment process and will have a developed stewardship approach.

Participate in or signed with the Global Real Estate Sustainability Benchmark (GRESB):

The GRESB portfolio assessment and carbon emissions data footprinting tools provide us with a comparable and consistent way of analysing the ESG performance of funds. The Fund requires all investment funds to report against the GRESB assessment annually, and we seek managers with strong performance relative to their peers as part of manager selection. For existing managers, the underlying performance data provided in each GRESB assessment supports ESG integration activities by providing transparent and comparable data on fund progress on material ESG and impact factors, helping us to identify areas of opportunity and risk in our portfolio.

The Fund invests in other investment funds and the data is directly received from the external investment managers. Anthos relies on the provision of accurate and correct information by the external investment manager. For the reporting on certain PAI indicators, relevant data sources include the Sustainalytics Global Standards Screening and Controversy screening.

The below provides more information about how the Fund promotes environmental or social characteristics.

1. No sustainable investment objective

This Fund promotes environmental or social characteristics but does not have as its objective sustainable investment.

2. Environmental or social characteristics of the financial product

The Fund is a so-called ‘fund of fund’, meaning that it invests in other investment funds. The Fund does not promote specific environmental or social characteristics directly, but overall aims to invest in investment funds that promote one or more environmental and/or social characteristics such as climate change, resource efficiency and human wellbeing.

No reference benchmark has been designated to attain the promoted environmental or social characteristics.

3. Investment strategy

This financial product aims to deliver a long-term target return equal to or higher than the INREV ODCE Consultation Index. This financial product will invest indirectly in real estate, by participating in unlisted and listed real estate investment funds. This financial product invests predominantly in unlisted real estate investment funds and will adopt a core+ investment theme. It will seek to achieve target returns through strategic allocation based on market analysis and manager selection. Core funds are the basis of the strategy, supplemented by very select value-add and opportunistic strategies and listed real estate investment funds.

It promotes environmental and social characteristics:

- In the selection of the investment managers themselves (measured by the ESG scorecard) and the investment strategies they implement (measured by the ESG scorecard and the IMP scorecard); and

- By engaging with these investment managers on the implementation of ESG practices in their investment and management decisions.

As a fund of funds, this financial product invests in investment funds controlled by other investment managers. Promotion of environmental and social characteristics is achieved by selecting investment managers that have Environmental, Social and Governance (ESG) practices integrated in their investment process with well-developed or developing engagement or stewardship approaches. The Anthos Responsible Investment policy, Anthos Positions and Exclusions policy and Anthos Stewardship policy apply to this financial product.

This financial product considers the following principal adverse impacts (PAI) on sustainability factors:

- PAI 17: exposure to fossil fuels through real estate assets

- PAI 18: exposure to energy-inefficient real estate assets

- PAI 18 (table 2): GHG emissions

Relevant information on principal adverse impacts on sustainability factors will be disclosed in due course in the Fund’s annual report.

This financial product does not invest directly in investee companies. This financial product invests indirectly in real estate assets, through its direct investments in external investment funds. Anthos expects the investment managers of those investment funds to assess good governance practices and Anthos monitors whether those investment funds have a policy on governance issues through the GRESB reporting, and the GRESB scores on process to implement governance policies and governance risk assessment.

4. Proportion of investments

The Fund aims to invest at least 80% in investment funds aligned with the environmental or social characteristics of the Fund.

5. Monitoring of environmental or social characteristics

The portfolio manager conducts ESG and RI research as part of investment analysis and maintain ESG scorecards for all managers. They work with fund managers to strengthen the integration of ESG into their investment processes, improve their ESG/RI policies, enhance ESG reporting and incorporate responsible investment into their policies as much as possible. This financial product invests at least 80% of its assets in investment funds of which the investment managers have been assessed on ESG and which have an ESG rating of "Professional" or "Leader" and invests at least 80% of its assets in investment funds assessed with an “A”, “B” or “C” IMP label. This financial product only invests in investment funds that have signed with the GRESB or have provided a clear commitment to participate. The GRESB initiative enables investment managers to show yearly progress on the most important ESG metrics and provides a strong basis for engagement.

Anthos assesses all investment funds that are considered for this Fund on responsible investment practices and key ESG characteristics prior to investing, using its proprietary tools (ESG and IMP scorecard). Anthos uses the following indicators to measure the attainment of the promoted environmental or social characteristics:

- at least 80% is invested in investment funds of which the investment managers have been assessed on ESG and which have an ESG rating of "Professional" or "Leader".

- at least 50% is invested in investment funds assessed with an IMP label “A”, “B” or “C”.

- This financial product only invests in investment funds that have signed with the GRESB or have provided a clear commitment to participate. The GRESB initiative enables investment managers to show yearly progress on the most important ESG metrics and provides a strong basis for engagement.

As part of the monitoring activities, the Fund engages with and evaluates each managers’ ESG and IMP scorecards at least annually and in response to material events.

6. Methodologies

Anthos uses the following tools and methodologies to measure the social or environmental characteristics promoted by the Fund:

1. GRESB Annual Performance, both absolute and relative to peers;

2. Internal ESG rating method that looks at the following components:

a. With regard to the investment manager: Purpose & culture alignment, Diversity, equity and inclusion, Policy and strategy, Resources and governance and Industry leadership.

b. With regard to the investment fund: ESG integration in the investment process, Negative impact taken into account, Exclusions, Engagement, Proxy voting and Reporting in line with relevant standards.

Resulting in an ESG score of ‘Laggard’, ‘Novice’, ‘Professional’ or ‘Leader’.

3. Internal IMP scorecard that looks at the following components: the impact intention of the investment fund on ESG elements, the allocation of assets with an impact intention and how it is measured and managed within the investment fund.

Resulting in an IMP label of ‘A’, ‘B’, ‘C’ or ‘M/D’.

7. Data sources and processing

Anthos collects data from the external investment managers during the due diligence phase and during engagement conversations. The received information is reviewed by the portfolio manager and used for the internal assessment resulting in an ESG rating and an IMP label. The relevant information is reviewed at least once a year. Since all the information is received directly from the investment managers, Anthos doesn’t use any estimated data at the moment. In addition, Anthos is an investor member to GRESB which provide annual independent assessment of ESG performance of funds.

8. Limitations to methodologies and data

The Fund invests in other investment funds and the data is directly received from the external investment managers. Anthos relies on the provision of accurate and correct information by the external investment manager. Currently, Anthos doesn’t use any external data provider to verify the received information.

Assessing the information shared by the external investment managers may be influenced by the amount of knowledge of the Anthos staff performing the assessment on ESG rating and IMP label. Anthos mitigates this limitation by providing regular training to its staff, either on processes or specific topics (for example climate training and human rights workshops). The RI Team also may review the ESG and IMP scores completed by the investment team to ensure the correctness of the scores.

9. Due diligence

As part of the due diligence process the environmental, social and governance factors of external investment manager as well as the investment fund are investigated by the portfolio manager. Therefore, the external investment manager has to provide the information necessary for Anthos to be able to perform the ESG and IMP assessment and evidence that they meet the minimum thresholds. Once the information is received, Anthos will assess the information resulting in an ESG score ‘Laggard’, ‘Novice’, ‘Professional’ or ‘Leader’. And also, in an IMP label ‘A’, ‘B’, ‘C’ or ‘M/D’. Anthos views ESG performance of real estate portfolios as an indicator of quality and, therefore, seek to invest in strong performing portfolios. At least 80% of funds must be investment managers that have been assessed on ESG and which have an ESG rating of "Professional" or "Leader", and at least 50% is invested in investment funds assessed with an IMP label “A”, “B” or “C”.

During the due diligence, the first assessment is done by the portfolio manager. The assessments are also reviewed by the Anthos Responsible Investments Team on a need basis and the tools are continuously improved to keep up with market standards.

10. Engagement policies

As a fund of fund manager, Anthos invests in investment funds managed by external investment managers, and it relies on these external investment managers for engagement in connection to the investments made. As part of active ownership, the portfolio manager regularly engage with fund managers on finance and ESG matters (at least annually) to ensure the portfolios are progressing in line with business plans and Anthos’ expectations, and to enhance investor stewardship and the pursuit of responsible investment.